Supermarket positioning: Albert Heijn vs. Jumbo

How important is positioning for a supermarket (brand)? Albert Heijn has held the largest market share for a long time but sees Jumbo making strong progress. The market seems to favor Jumbo more while Albert Heijn maintains its market share with more stores. Now that Jumbo is taking over V&D’s bankrupt La Place, AH probably feels the pressure even more, because what happens if Jumbo becomes even stronger? In this case, positioning is more interesting than market share, because that is apparently for sale. Is Albert Heijn’s positioning stronger than Jumbo’s? We discuss this crucial question.

Before we dive into the content of the article, we would like to share our podcast in which we also discuss the positioning of both supermarket chains:

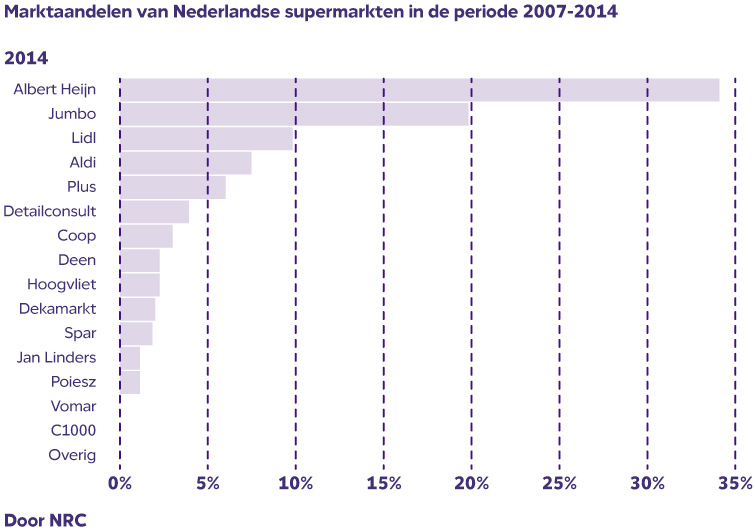

Market Share

Market Share

Albert Heijn has been the largest in terms of market share for years. From 2007 to 2017, the market share grew annually but the brand had to give ground for the first time in 2018 while Jumbo grew. At the end of 2018, Albert Heijn’s market share was 34.7%, more than half a percent less than the year before. Jumbo grew by 0.4 percent to 19.1% while Lidl also gained 0.4%.

Jumbo worked hard in the years after its founding but had only 36 stores in 2002. It wasn’t until after the purchase of Laurus supermarkets in 2007 that it really started competing. With the acquisition of the Super de Boer formula in 2009 and C1000 in 2011, Jumbo conquered second place in the supermarket landscape and has steadily increased its market share since then.

Don’t find your question answered in this blog? Ask me the question by email and we will add it!

But market share is not the right way to assess the performance of a supermarket brand. Albert Heijn has by far the most stores, about 360 more than Jumbo, and the highest market share per store at 0.036%. But Albert Heijn probably also has the most expensive stores in the best locations, which yield the most but what do you really gain from it? Albert Heijn reported an operating margin of 4.9% in 2017 while Jumbo recorded 6.1% normalized EBITDA in its Annual Report. Does this mean Jumbo is the winner? Albert Heijn has almost twice the revenue. I think we won’t get anywhere this way.

It is much more interesting to look at how the positioning of both brands develops.

Positioning Albert Heijn

At the beginning of 2016, Ahold replaced the general director of Albert Heijn. Quite strange with a market share of 35%, according to retail marketing professor Laurens Sloot, if it weren’t for the fact that the

supermarket chain is an oil tanker. And the ship is now off course. According to him, the company has lost touch with the consumer and feels pressure from competitors Jumbo, Lidl, and the Superunie group (Plus, Spar, etc.). In important quality metrics such as the quality of the fresh produce department, AH consistently loses to budget chain Lidl.

On its own ‘About Albert Heijn’ page, the company writes:

The everyday affordable, the special accessible

We have all your daily groceries in stock. Everyday items like toilet paper, detergent, diapers, and toothpaste, potatoes, milk, and bread. At Albert Heijn, you are assured of excellent quality at an affordable price. And we sell many special products that you often only find with us or in a specialty store. Our own brand AH Excellent offers a wide selection of special products to enjoy even more, with dozens of special Christmas and Easter products every year. We are also always looking for interesting new products to surprise you. And you will find all these special products at Albert Heijn for the best price, because we want to make the special accessible to everyone!

Am I coming to Albert Heijn now for price, service, or innovation? You tell me, because the company itself seems unsure. The above story gives us quite an ‘ego’ feeling. “We are so good, if not the best!” seems to be Albert Heijn’s message. We stick with the oil tanker adrift metaphor.

Positioning Jumbo

Jumbo is a true family business and according to its own history page was founded in 1921. The latest generation completely revamped the concept in 1996 and introduced the 7 certainties based on research into consumers’ biggest annoyances. With these 7 certainties, the company put the customer fully at the center and took the first step towards the number two position they now hold. Jumbo has existed for years but only came on many people’s radar in 2007 and grew mainly through the acquisition of Super de Boer and C1000 in 2009 and 2012, becoming the second-largest supermarket company in the Netherlands. Recently, Jumbo made the news again with an acquisition, this time taking over La Place from the bankrupt V&D estate, which experts consider a masterstroke.

Jumbo speaks of a mission and states the following on its own page:

Exceeding expectations

At Jumbo, we want to exceed expectations. Every day, everywhere, for every customer. That’s why we offer a formula that goes further. A store that has everything sorted. The very best service, the largest and best assortment, and the lowest price. In every aspect, we want to offer our customers the best. Guaranteed and without having to make a single compromise. That’s how we turn Jumbo customers into real Jumbo fans.

Although Jumbo also wants to have ‘everything’, unlike Albert Heijn, the company does have a central gauge: customer satisfaction. We get a more social feeling from Jumbo but the company is more of a ‘follower’ in terms of innovation and concepts and thus more conservative.

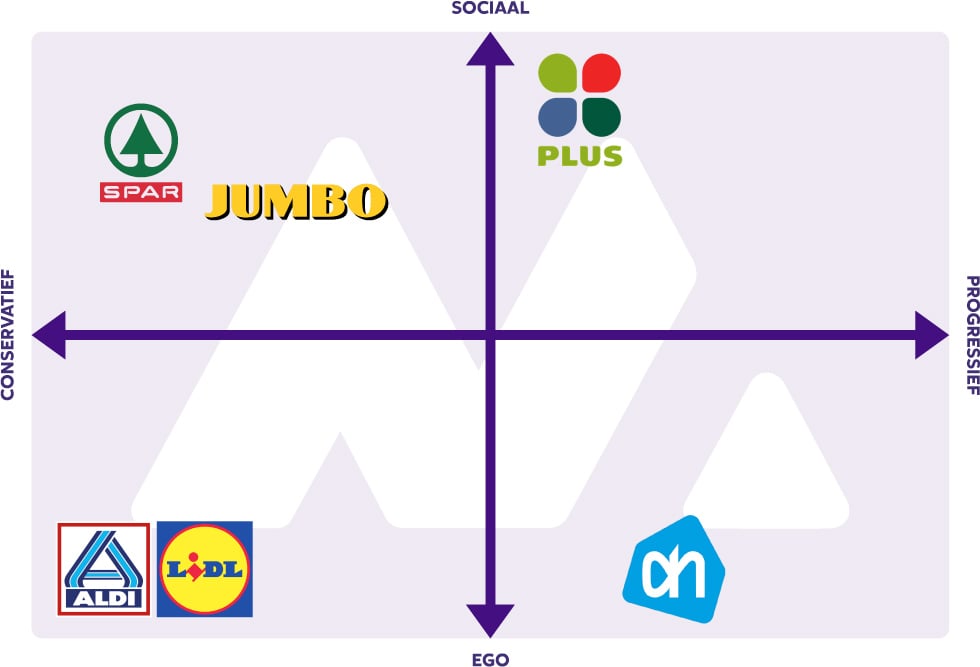

Supermarket Competition Matrix

An important tool for positioning for us is the competition matrix. This helps you objectively compare the competition’s marketing (as far as possible when it comes to marketing) against your own brand.

Here too, the competition matrix helps us look at the market differently. Bottom left are the price fighters, the lower the price the better. With their clear positioning, they appeal to a significant part of the market; Lidl is perhaps the most successful here with their positioning roughly as ‘cheap but with the best vegetable department’. Plus and Spar belong to the same group, where Plus is best comparable to Jumbo and AH while Spar is mainly a neighborhood supermarket. Together with Jumbo, they are at the top of the matrix due to their customer focus. The higher progressiveness of Plus is caused by their unique positioning around attention to organic products. Albert Heijn’s positioning is found at the bottom right due to the aforementioned ‘ego’ message and AH’s innovations such as pickup points, self-scanning, etc.

Conclusion: Albert Heijn’s flawed positioning gives Jumbo opportunities

Remarkably, in the competition matrix we see that Albert Heijn manages to claim a unique and distinctive position while we earlier concluded that the positioning leaves much to be desired. By wanting everything, the brand ends up with nothing in the eyes of the target group. We believe Albert Heijn’s innovations are what the market demands but they cannot reap the benefits because the brand is not clearly positioned.

Jumbo responds well to the more ‘social’ needs of the market and tries to expand its position with the recent acquisition of La Place. Jumbo quietly builds on its success while Albert Heijn will probably change course in the near future. It will be interesting to see what happens if Albert Heijn actually starts losing market share for the first time? Maybe that is what it takes to wake the brand up and make it show its true colors.

Want to know more about positioning and how you can get started yourself? Read our positioning page and find there, besides in-depth articles, also dozens of examples and models for every possible positioning challenge.