Competitor matrix; strategic perspective on marketing and positioning

Our positioning matrix addresses the effectiveness of marketing efforts by exploring the tension between identity and perception with the question, “Are you succeeding in communicating your organization’s distinctive positioning to the market remarkably?”

In practice, it turns out that few organizations can satisfactorily answer this; but what should be done next? That important question is where the competitor matrix finds its origin; should you adjust your positioning, or should you communicate differently?

Origin of the competitor matrix

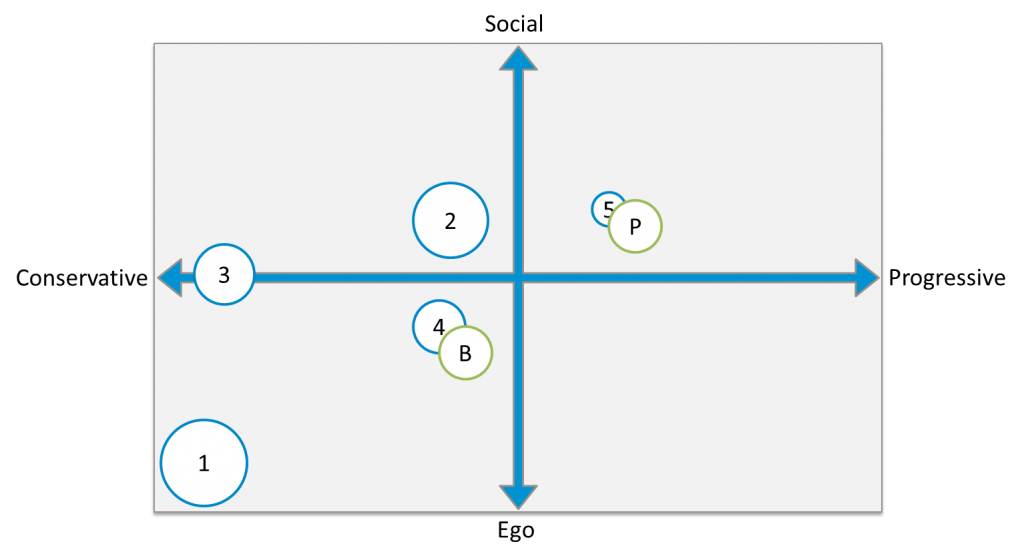

To make this assessment, we use the competitor matrix to display message and behavior. The message, for example, is about what you say, and behavior is about how you say it, but another way to look at both aspects is content versus form. To provide insight into this assessment, we have linked each of these terms to its own axis. Both axes represent an extreme opposition, making it possible to compare positionings without being subjective about quality. Keep in mind that we have examples of successful organizations in every part of the matrix and that a -5 position on both axes is not a value judgment and thus says nothing about the success of an organization. We explain both axes individually:

Behavior: Conservative vs. Progressive | The behavior axis places brands based on their innovativeness in conveying the message. Do they prefer to tread well-worn paths, or are they open to a unique approach? How innovative or distinctive is the approach? This could also mean, for example, reviving a forgotten channel. Possible considerations:

- Is a variety of means being used? (e.g., events, video, guerrilla actions, or sponsorships) Or is it mainly advertising in traditional media?

- What about the use of new or social media?

- Conservative statement: we’ve been doing it this way for years, and it works fine.

- Progressive statement: we’re always curious about how we can stay ahead of developments.

Message: Ego vs. Social | From our experience, the ego vs. social assessment is particularly suitable for objectively comparing the messages of brands. A more ego-oriented brand has a take-it-or-leave-it attitude, while a more social brand primarily focuses on the needs and wishes of its customers. Possible considerations:

- Is the brand engaging with its customers, or is it just broadcasting?

- Does the brand encourage co-ownership/co-creation, or is it keen on retaining brand control and ownership?

- Do customers have an influence on the product, communication, or marketing?

Use of the competitor matrix

To determine the 0-line of both axes, it’s necessary to establish as objectively as possible what is standard in the market. Then, competing brands are placed relative to that average. The position of your competitors in the matrix is solely determined by how they are perceived by the market, as you have only (very) limited insight into the desired positioning of your competitors. Optionally, you can determine the size of the different competitors based on a third value (e.g., market share, marketing budget, or quality). This way, your most important competitors are displayed more prominently.

Then, you place your own organization twice in the matrix:

- the position that follows from your positioning

- the position that corresponds to the market’s perception of your brand

Using the competitor matrix results, as you see, in a clear market overview, giving you insight into how best to adjust your behavior and/or message to more clearly distinguish your brand from the competition.

We’d like to explain this with an example:

The above situation is similar to that in many industrial and other established markets. Market leader no. 1 prefers to keep everything as it is, relying on its own (considerable) status and esteem to maintain its market share. No. 2 realizes that distinction is necessary but is afraid of alienating the traditional market too much, while no. 3 (in vain) attempts to copy the behavior of no. 1. No. 4 is actually quite satisfied and simply focuses on serving existing (long-term) customers. No. 5 is a relatively new player seizing all opportunities to stand out.

The client (green) is best compared to no. 4 – and the perception (G) of the organization’s behavior reflects this too – but realized they were on a dead-end path. The new positioning (P) needs to clearly distinguish them from the (established) competition. Although there are multiple paths to a distinctive result, you must realize that the market’s perception of a brand can only be changed gradually. Therefore, it’s wise to use openings in the market to grow towards a new positioning.

In this case, a distinctive direction would be to adopt a more progressive attitude while only slightly changing the message. Only once the employees are familiar with the new expected behavior can you decide to gradually communicate a different message. This ensures that not two major course corrections happen at once, maintaining peace within the organization.

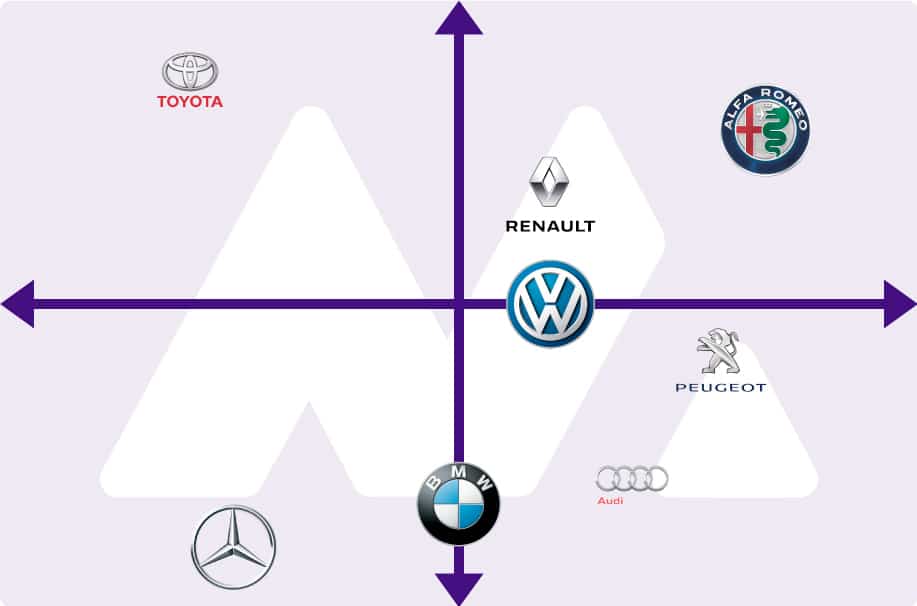

To also give you an intuitive idea of what the Competitive Matrix entails, we have filled it with a number of well-known car brands: