Positioning Research: Mapping the Competition in 5 Steps

Once the decision is made to overhaul the positioning, we often need to go back to the beginning. For some clients, this might seem like a repetition of steps. After all, many aspects of a thorough positioning study have already been briefly discussed in the conversations leading up to the positioning process. Why is additional research necessary? The answer is straightforward: market and organizational blindness. People who have been active in a company and market for many years often unconsciously develop tunnel vision and miss important changes, trends, or opportunities. A fresh perspective can work wonders and provide you with fascinating insights into the evolving market. Good research provides us with the ammunition to engage in meaningful discussions with clients about market direction and opportunities.

However, what exactly should we investigate? That varies from company to company and market to market. Many industrial companies have a small (potential) customer group for which target group research may not provide much additional insight. This is a completely different situation from that of a bleeding-edge IT company where the market may change every year. So, what we investigate varies depending on the company and market, but there is one aspect we always examine: the competition.

The goal of competitive research, in this case, is simple: to determine the factors, characteristics, or concepts that distinguish or are intended to distinguish the competition in the market. By determining the “mix” for each of the relevant competitors, we can later place them in a consistent framework compared to ourselves. Furthermore, this is often a refreshing perspective to use when looking at your own organization.

Researching the competition as part of the positioning research can lead to interesting and sometimes confrontational questions. For example: “That’s interesting! Three competitors are focusing heavily on delivery and response times. Why are they doing that? How do we actually perform in that area?”

A common pitfall in practice is that you may be looking at the competition from the wrong perspective; you view your competitors differently than your target audience does. For example, you may know that a competitor does not actually provide the “highest possible quality” or is not truly “customer-centric,” but does the target audience know that? The target audience makes choices based on the information they have, and you need to determine what that information is.

1. Analyzing the Slogan and/or Proposition of the Competition

What is the core of the competitor’s positioning? What is the central focus of all the marketing and communication of the organization? Translate this into your own words and, if possible, into more general characteristics. For example, Coolblue’s “everything for a smile” is equivalent to customer satisfaction/service, and Philips’ “innovation and work” is equivalent to innovation.

Examples:

– Coolblue “everything for a smile” = customer satisfaction/service

– Philips “innovation and work” = innovation

– Miele “There is no better” = quality

– Mercedes “Das Beste oder nichts” = quality

In practice, competitors often lack focus in their slogans or propositions and try to use as many of these terms as possible alongside each other. Therefore, it is often quite a challenge to determine the main focus of a competitor.

2. Analyzing the Offering of the Competition

What exactly does the competitor offer? Which products do they sell, and what services do they add to them or vice versa? It is easy to think that Coolblue simply sells electronics, but what the company actually offers is quite different. We wrote a blog post about Coolblue that delves into this topic.

By thoroughly mapping the complete offering and all its facets for each competitor, it is possible to compare the offerings of competitors among themselves and with your own. You can also start analyzing which connections exist between the offering and the proposition.

The desired end result is a schematic overview of the complete offering for each competitor.

3. Analyzing the Message of the Competition

The next step after a slogan or positioning is the message. When evaluating the message, we discuss many “soft” aspects such as tone, style, word usage, and address (formal or informal) that are essential for later analysis. For example, categorizing tone into 5 categories (e.g., from personal to distant) can help make these soft aspects measurable and comparable.

The desired end result is a brief “pitch” of the competitor’s message, along with an actual piece of text used and an overview of categorized elements and their evaluations.

4. Analyzing the Visual Identity of the Competition

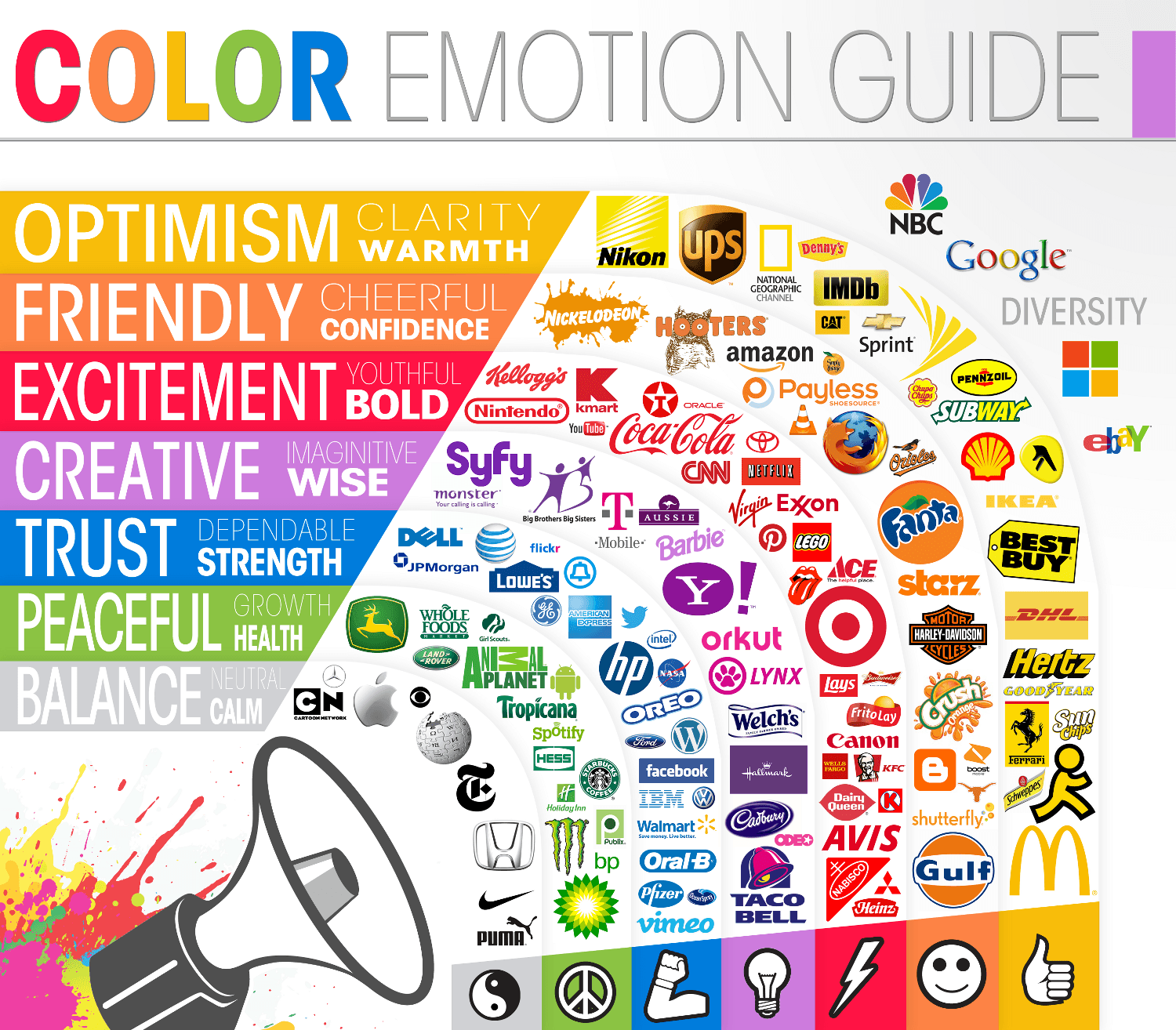

Zoals je op deze infographic van Logo Company ziet kan alleen kleur al de eerste richting aan een positionering geven.

A good positioning connects all aspects of marketing and communication. And the visual identity is, of course, a part of it. Especially in more technically oriented companies, the mantra often goes: content over form, while for the customer, it’s often the form that determines the first impression. Just like with the message, we use some ‘soft’ aspects here to compare competitors. Aspects such as color usage, shapes and lines, photography style, white space, and typography are all elements that you can investigate and categorize.

The desired end result is an overview of the various factors and a categorized evaluation of each factor for each competitor.

5. Analyzing the Means and Channels of the Competition

“Medium is the message,” said Marshall McLuhan, referring to the fact that the medium influences how we receive a message. That was in 1964, and since then, many new channels have emerged. When we talk about means and channels, we are essentially talking about the carriers of your message.

Why is the choice of channels and means so important? How much is an advertisement in a newspaper worth if your target audience doesn’t read that newspaper? This might seem obvious, but the majority of marketing budgets are still spent on ‘old familiar’ channels.

That’s why the question of which means and channels the competition uses is so crucial. Combined with the information from your target audience research and analysis, you can then determine where the opportunities are to stand out.

The desired end result for the competitive research is an overview of the means and channels used by each competitor.

Positioning Research: Competitive Analysis

The above 5 steps have undoubtedly given you a good insight into the positioning of your competition. Often, you can make enough progress without formally analyzing this, but we recommend making the effort. What are interesting aspects to analyze? For inspiration, here are some examples:

By using, for example, the Merkelijkheid Competitive Matrix, you can create a very clear overview of the different positions in the market and compare them with aspects such as means and channels, visual identity, and offerings. This makes decision-making much easier.

Comparing the means and channels that the competition uses with those used by the target audience can point you to opportunities for differentiation. Make sure you are where your target audience is!

Compare the visual identity of competitors with their positioning. On which aspects do they place the most emphasis? Should you follow suit, or is there room for differentiation?

For many companies, competitive analysis forms the basis for the subsequent steps in positioning. It provides essential insights into how the market has evolved in recent times and what opportunities there are to stand out. The above 5 steps certainly provide enough food for thought and discussion and will be an eye-opener even for the most entrenched colleague.

Positioning is what keeps De Merkelijkheid awake day and night. This article discusses one of the first steps in actually working on your positioning, but in many cases, this is not where it begins. Often, you first have to establish the necessity, the burning platform (what if we do nothing?). Finally, we leave you with some questions that can lead to the right conversation:

- How should your brand be known among your target audience?

- What can you offer that the competition cannot, or not as well?

- Which positioning aligns with your company’s goals and vision?

- Is there sufficient budget available to truly work on your positioning?

- Are you really thinking long-term?

If you want to learn more about positioning and how to work on it yourself, read our Positioning page, where you’ll find in-depth articles as well as dozens of examples and models for every possible positioning challenge.”

I hope this helps! If you have any more questions or need further assistance, feel free to ask.