*Positioning

Positioning supermarkets: Albert Heijn vs. Jumbo

How important is positioning for a supermarket brand? Albert Heijn has had the largest market share for a long time, but Jumbo is rapidly expanding. It seems that the market is becoming more favorable for Jumbo, while Albert Heijn is maintaining its market share with more stores. Now that Jumbo is acquiring V&D’s bankrupt La Place, Albert Heijn probably feels even more pressure, as what happens when Jumbo becomes even stronger? In this case, positioning is more interesting than market share because it seems market share can be bought. Is the positioning of Albert Heijn stronger than that of Jumbo? We will discuss this crucial question in this article.

Before we delve into the content of the article, we would like to share our podcast in which we also discuss the positioning of both supermarket chains. (In Dutch)

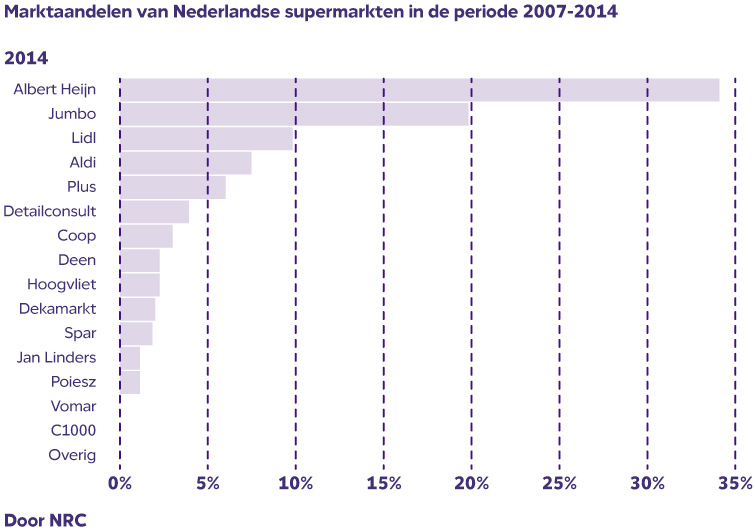

Market Share

Albert Heijn has been the largest in terms of market share for years. From 2007 to 2017, its market share grew annually, but the brand had to give up some ground in 2018, while Jumbo continued to grow. By the end of 2018, Albert Heijn’s market share was 34.7%, slightly over half a percent less than the previous year. Jumbo grew by 0.4% to 19.1%, while Lidl added 0.4%.

Jumbo worked hard to expand in the years following its establishment but had only 36 stores in 2002. It only truly became a competitor after acquiring the Laurus supermarkets in 2007. With the purchase of the Super de Boer formula in 2009 and C1000 in 2011, Jumbo claimed the second position in the supermarket industry, and its market share has been steadily increasing since then.

However, market share is not the right way to assess the performance of a supermarket brand. Albert Heijn has by far the most stores, approximately 360 more than Jumbo, and the highest market share per store at 0.036%. But Albert Heijn probably also has the most expensive stores in the best locations, which may generate the highest revenue, but what is the profit margin? In 2017, Albert Heijn reported an operational margin of 4.9%, while Jumbo recorded 6.1% in normalized EBITDA in its Annual Report. Does this mean that Jumbo is the winner? Albert Heijn has nearly twice the revenue. I don’t think we can resolve this issue using these metrics.

It is much more interesting to examine how the positioning of both brands is developing.

Positioning Albert Heijn

In early 2016, Ahold replaced the CEO of Albert Heijn. This might seem unusual given their market share of 35%, as noted by retail marketing professor Laurens Sloot, but it was not entirely unexpected considering the ever-evolving dynamics of the retail industry.

And the ship is now changing course. According to him, the company has lost touch with the consumer and feels pressure from competitors Jumbo, Lidl, and the Superunie group (Plus, Spar, etc.). In key quality indicators, such as the quality of the fresh department, AH consistently loses to budget concern Lidl.

And the ship is now changing course. According to him, the company has lost touch with the consumer and feels pressure from competitors Jumbo, Lidl, and the Superunie group (Plus, Spar, etc.). In key quality indicators, such as the quality of the fresh department, AH consistently loses to budget concern Lidl.

On the company’s ‘About Albert Heijn’ page, it writes:

The everyday affordable, the extraordinary within reach We have all your daily groceries in stock. Everyday items like toilet paper, detergent, diapers, and toothpaste, potatoes, milk, and bread. At Albert Heijn, you can count on excellent quality at an affordable price. And we sell many special products that you often only find with us or in a specialty store. Our own brand AH Excellent offers a wide choice of special products for extra enjoyment, with dozens of special Christmas and Easter products every year. Moreover, we are always looking for interesting new products to surprise you with. And you can find all these special products at Albert Heijn for the best price because we want to make the extraordinary accessible to everyone!

Am I now coming to Albert Heijn for the price, service, or innovation? Tell me because the concern doesn’t seem to know itself anymore. The above story at least gives us quite an ‘ego’ feeling. Albert Heijn seems to say, “We are so good, if not the best!” We stick with the drifting oil tanker.

Jumbo’s Positioning

Jumbo is a true family business and, according to its own history page, was founded in 1921. The latest generation completely overhauled the concept in 1996 and, based on research into consumers’ biggest annoyances, introduced the 7 certainties. With these 7 certainties, the company put the customer at the center, marking the first step towards the second position they now hold. So Jumbo has been around for years but only came on many people’s radar in 2007 and grew mainly through the acquisition of Super de Boer and C1000 in 2009 and 2012, becoming the second-largest supermarket company in the Netherlands. Jumbo has also recently been in the news with an acquisition, this time acquiring La Place from the bankrupt V&D estate, which experts consider a masterstroke.

Jumbo speaks of a mission and states the following on its own page:

Exceeding expectations At Jumbo, we want to exceed expectations. Every day, everywhere, for every customer. That’s why we offer a formula that goes further. A store that has everything. The very best service, the largest and best assortment, and the lowest prices. In every aspect, we want to offer our customers the best. Guaranteed, without having to compromise on anything. This is how we turn Jumbo customers into true Jumbo fans.

Although Jumbo also wants to have ‘everything,’ unlike Albert Heijn, the company does have a central benchmark: customer satisfaction. We get a more social feeling from Jumbo, but the company is more of a ‘follower’ in terms of innovation and concepts and is therefore more conservative.

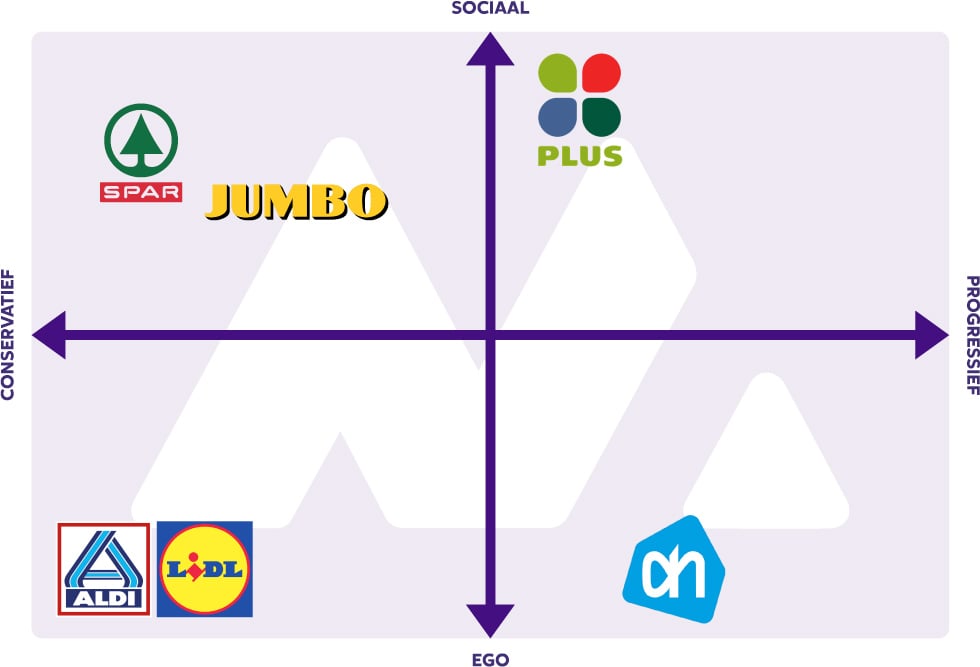

Supermarket Competition Matrix

An important tool in positioning for us is the competition matrix. This helps you objectively compare your competition’s marketing (to the extent possible in marketing) against your own brand.

Here too, the competition matrix helps us to look at the market in a different way. In the bottom left are the price fighters, where the lower the price, the better. With their clear positioning, they appeal to a significant portion of the market, with Lidl perhaps being the most successful in positioning themselves as ‘cheap but with the best vegetable department.’ Plus and Spar belong to the same group, where Plus is most comparable to Jumbo and AH, while Spar is more of a neighborhood supermarket. Together with Jumbo, they are at the top of the matrix due to the customer focus they prioritize. Plus’s higher progressiveness is due to their unique positioning around attention to organic products. Albert Heijn’s positioning is found in the bottom right due to the aforementioned ‘ego’ message and AH’s innovations such as pickup points, self-scanning, etc.

Conclusion: Albert Heijn’s inadequate positioning offers opportunities for Jumbo

Remarkably, in the competition matrix, we see that Albert Heijn manages to claim a unique and distinctive position, while we previously concluded that the positioning leaves something to be desired. By wanting to be everything to everyone, the brand ends up with nothing in the eyes of the target audience. We believe that Albert Heijn’s innovations are what the market demands, but they cannot reap the benefits because the brand is not clearly positioned.

Remarkably, in the competition matrix, we see that Albert Heijn manages to claim a unique and distinctive position, while we previously concluded that the positioning leaves something to be desired. By wanting to be everything to everyone, the brand ends up with nothing in the eyes of the target audience. We believe that Albert Heijn’s innovations are what the market demands, but they cannot reap the benefits because the brand is not clearly positioned.

Jumbo plays well to the more ‘social’ needs of the market and is trying to expand its position with the recent acquisition of La Place. Jumbo is steadily building on its success while Albert Heijn is likely to change its course in the near future. It’s quite interesting to see what would happen if Albert Heijn were to actually start losing market share for the first time. Perhaps that’s what it takes to wake up the brand and make it take a clear stand.

If you want to learn more about positioning and how to work on it yourself, check out our Positioning page, where you’ll find in-depth articles as well as dozens of examples and models for every possible positioning challenge.